USD/PKR Forecast for 2023-2025: Will Pakistan Rupee Continue to Decline?

Will Pakistan Rupee Continue to Decline?

The USD/PKR exchange rate is a basic marker of Pakistan’s financial stability and health. The recent dramatic decrease in the value of the Pakistani rupee relative to the US dollar over the past 1 year after the toppling of Imran Khan Govt in the month of April 2022 has made investors, decision-makers, and residents alike worried. This article examines the factors influencing the USD/PKR conversion rate and makes a prediction about whether the Pakistani rupee will continue to decline in value in the near future.

Bank of America (BofA)Securities has predicted that Pakistan’s currency could devalue to Rs340 against the US dollar due to high domestic borrowing, substantial interest payments, and the need to restructure unsustainable debt in 2024 and 2025.

tribune.com

USD to PKR Exchange Rate Forecast 2023-2025

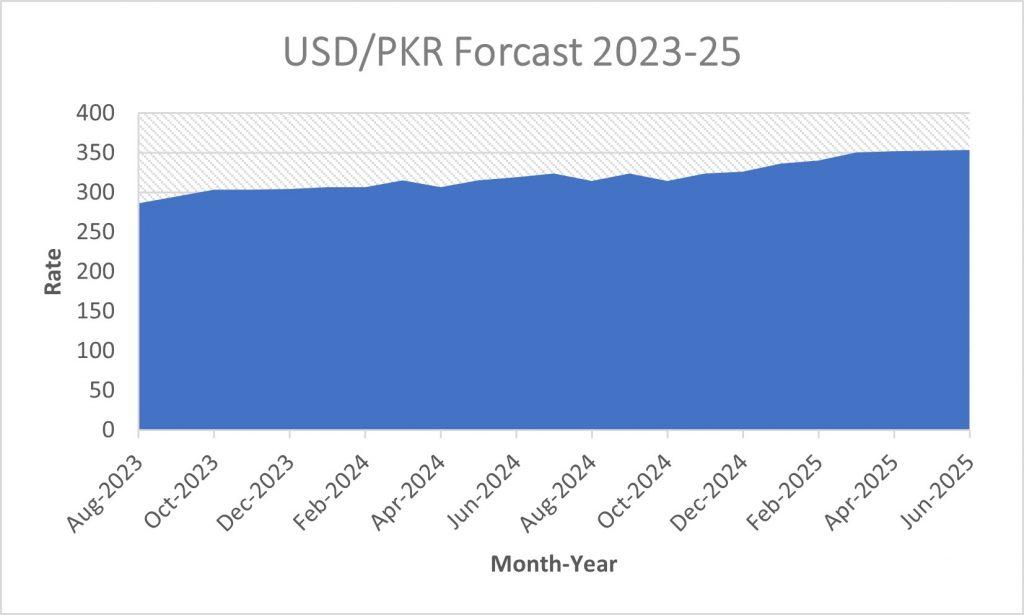

Below is the forecast of USD/PKR exchange rates published by the Economy Forecast Agency (EFA) for the years 2023, 2024, and 2025. EFA specializes in long-range financial market forecasts and uses mathematical and statistical methods of prediction based on existing historical data.

The forecast clearly shows the USD/PKR exchange rate will touch 300 in the last quarter of 2023, will stabilize for a few months but continue to decline at a steady pace, and might tough 350 by mid of 2025.

Driving factors of USD/PKR exchange rate

The USD/PKR exchange rate fluctuates because of several factors which include:

a) Balance of Trade: Pakistan’s trade balance largely determines the exchange rate. A country partakes in a current account deficit when its imports exceed its exports, which causes the local currency to appreciate.

b) FDI, or direct foreign investment: The volume of foreign direct investment has an impact on the exchange rate in Pakistan. Increased FDI increases local currency demand, which could make the Pakistani rupee stronger.

c) Reserves from abroad: The country’s foreign reserves protect it from external shocks. The Pakistani rupee may be appreciated as a result of the country’s increased susceptibility to economic crises if foreign reserves are low.

d) Market Sentiment and Speculation: Short-term fluctuations in the currency rate can be caused by speculative actions and market mood. Theoretical innovations can be sparked by global financial weaknesses or international pressures.

To read more about Pakistan, Click here.

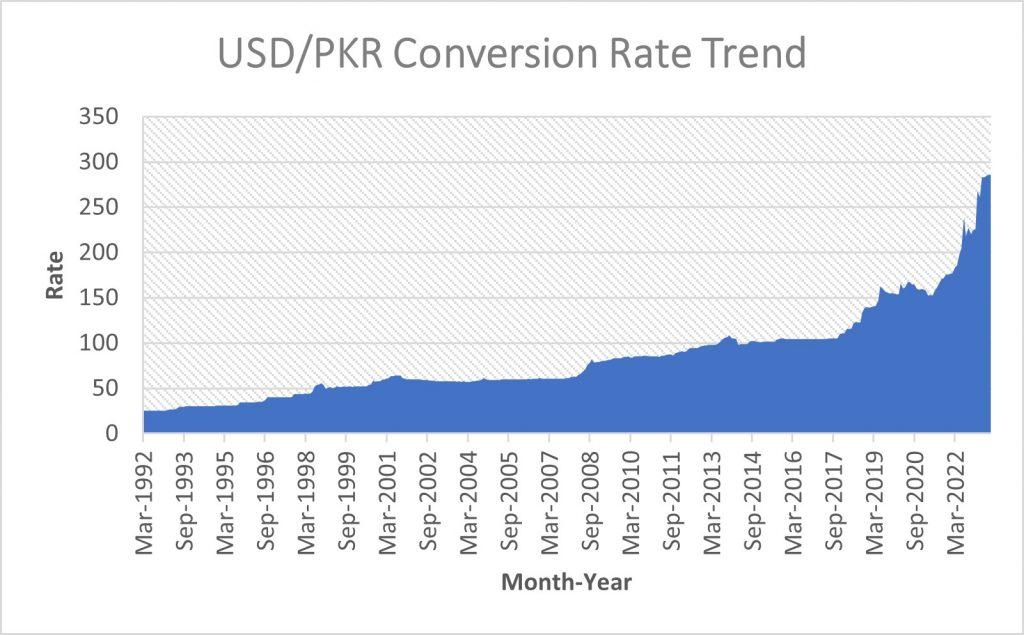

USD/PKR Historical trend of the Last 50 years

Let’s look at the history of the USD/PKR exchange rate to better understand the current situation. This long-term perspective can benefit the currency’s performance and underlying patterns.

The Pakistani rupee has historically appreciated and decreased in value to the US dollar.

The Pakistani rupee has seen phases of appreciation and depreciation versus the US dollar throughout the past seventy-five years, as shown by fluctuations in the USD/PKR exchange rate. These fluctuations have been influenced by many financial, political, and global factors.

Mid 1970s – Fixed Swapping scale:

The Pakistani rupee’s value was fixedly pegged to the US dollar at the beginning of the 1970s under a fixed exchange rate regime in Pakistan. During this period, the swapping scale remained moderately steady as the public authority kept up with severe command over its money.

Devaluation: Late 1970s to early 1980s

Pakistan faced economic difficulties in the late 1970s and early 1980s, including a crisis in the balance of payments and rising inflation. The government repeatedly devalued the Pakistani rupee against the US dollar to address these issues.

IMF Structural Adjustment and Bailout Programs in 1982:

In 1982, Pakistan sought help from the Global Financial Assets (IMF) because of mounting outer obligations and a decaying economy. The country implemented programs for structural adjustment as part of the IMF bailout. These programs included further devaluation of the rupee, subsidy reductions, and fiscal reforms.

Exchange Rate Reforms: From the late 1980s to the 1990s

Pakistan transitioned from a fixed exchange rate system to a managed float system in the late 1980s and early 1990s. The government allowed the rupee to fluctuate within a specific range against the US dollar depending on market forces and economic conditions.

1998 – Monetary Assents and Atomic Tests:

Pakistan carried out nuclear tests in 1998, which resulted in economic boycotts from the international community. Together with the Asian financial crisis, these sanctions caused a significant depreciation of the rupee against the US dollar.

IMF programs and external debt in the early 2000s:

Pakistan’s exchange rate stability was impacted by increased external debt at the beginning of the 2000s. Exchange rate adjustments were necessary to restore macroeconomic stability due to the country’s reliance on IMF programs to address its economic issues.

From the middle of the 2000s to the year 2010, a relatively stable period:

From the mid-2000s to around 2010, the USD/PKR swapping scale encountered a time of relative dependability. During this time, the Pakistani rupee was supported by robust economic growth, increased remittances, and foreign investment inflows.

Depreciation and Currency Crisis from 2013 to 2018:

Starting in 2013, the Pakistani rupee encountered a drawn-out time of deterioration against the US dollar. An expanding current account deficit, low foreign exchange reserves, and rising debt levels exacerbated the currency crisis. The rupee continued to weaken despite the government’s efforts to stabilize the exchange rate.

2019-2021 – Oversaw Deterioration:

Pakistan adopted a managed depreciation strategy in response to external pressures and an IMF bailout. The State Bank of Pakistan permitted controlled cheapening of the rupee to address the equilibrium of installment issues and increment trade seriousness.

Economic Factors Upon USD/PKR

Economic factors such as inflation, interest rates and government policies impact exchange rates.

a) Inflation: A country’s currency loses its purchasing power due to high inflation, which causes it to depreciate.

b) Interest rates: Investors from other countries may be drawn to Pakistan by higher interest rates. There by boosting demand for the country’s currency and strengthening the rupee.

c) Policies of the Government: The Pakistani government’s economic policies, fiscal discipline, and trade regulations significantly impact the exchange rate. Sound financial approaches can impart trust in the money and draw in unfamiliar ventures.

d) Payments in Balance: A sustainable balance of payments is essential for currency stability. If the equilibrium of installments decays, it can prompt a cash emergency and decrease the Pakistani rupee’s worth.

Political Factors Impacting USD/PKR

Political instability is one of the main reasons for instability in Pakistan. This discourages foreign investments and the trust of international bodies in Pakistan.

a) International Relations: Pakistan’s relationships with other countries and international organizations influence investor confidence and foreign investment. International strains and worldwide contentions might cause vulnerability and adversely influence the swapping scale.

b) Domestic Politics: Economic expansion and investor confidence depend on political stability. Unfortunately, Pakistan has hardly seen political stability since its independence excluding the periods of the military regime.

Conclusion

The USD/PKR exchange rate is a crucial indicator of Pakistan’s economic health and stability. Big concerns have been raised by investors, decision-makers, and citizens over the considerable depreciation of the Pakistani rupee against the US dollar in the coming years. The trade balance of the nation, foreign direct investment, foreign reserves, and market sentiment are only a few variables that affect the exchange rate. Currently, political stability, delay in elections, and a steady flow of IMF deal money seem to be the key issues to be resolved without which PKR will not be able to see stability in the near future.